York University Pension Fund has long been committed to sustainable investing. The impact of environmental, social and governance (ESG) factors on the risks and opportunities for the fund has been a recognized issue for many years and we have managed a strategy that considers the potential impact of these important issues on the portfolio. The fund integrates sustainability and ESG considerations into the selection and evaluation of the managers, and the information available to assess these factors has improved greatly over the last few years.

York's investment managers are expected to be able to provide context and examples of how they consider long-term sustainability and ESG factors in their analysis, investment decision making, and portfolio construction. We believe considering this important macroeconomic theme has contributed to our outstanding performance over the last decade. As importantly, the fund has achieved significant reductions on carbon emissions since measurement began in 2016.

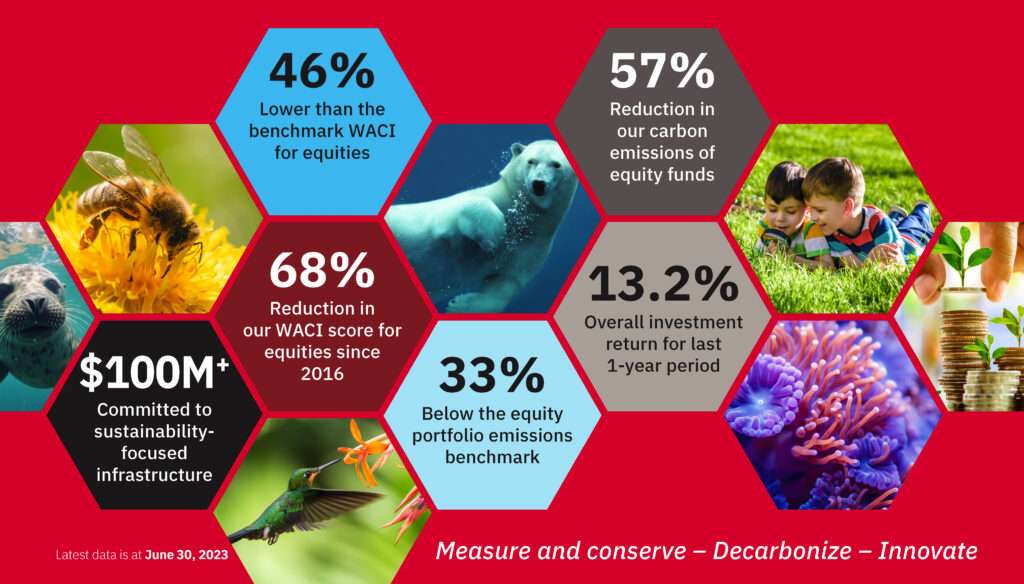

Sustainability Scorecard

The York University Pension Fund holds itself accountable through evidence-based factors and continues to work with our partners to keep improving our performance and meaningfully contribute to long-term sustainability. Our latest Pension Fund Sustainability Scorecard shows:

Learn More About Sustainability at York