The Royal Bank of Canada (RBC) now has a better understanding of how to attract international students to its services, thanks to a class of York University graduate students in the Master of Financial Accountability (MFAc) program.

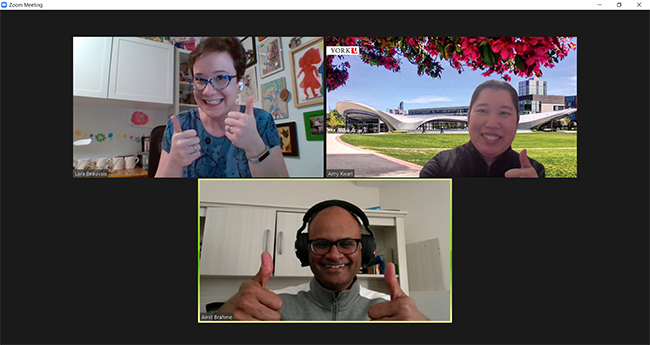

Amy Kwan, assistant professor in the teaching stream at the School of Administrative Studies, teamed up with a part-time faculty member from RBC to offer the graduate students in her Performance Measurement Systems class an experiential education (EE) opportunity, and the results have been beneficial to all parties involved.

Amit Brahme, senior director, Newcomer & Cultural Client Segment at RBC, who teaches a management accounting course at York, together with his colleague Lara Beauvais, senior manager, Performance Optimization & Early Talent Strategy, challenged students in Kwan’s class to determine how RBC could better connect with international students. This substantial segment – 640,000 students across Canada – is desirable for RBC to connect with, especially since 60 per cent of these students have expressed a desire to remain in Canada post-graduation.

Most of the students enrolled in Kwan’s class this spring were international students and related immediately to the problem put before them. “This hit home for them,” Kwan said. “Many of them have walked that ‘new incoming international student’ journey.”

The students regularly work on case studies, but this was a chance to “see how the tools and building blocks that they’ve learned get applied in industry,” Kwan said. “They are able to see how they will be able to leverage their knowledge in a future career.”

Brahme and Beauvais asked the students how RBC could connect better with international students during their journey; what resources could the bank make available to improve their outreach to this market segment and how could the bank measure its success in such endeavours? They attended an online class session to present the challenge, and the students collaborated in work teams to provide RBC with insights.

“It was a great opportunity to get some perspective from actual newcomers and see the issues from fresh perspectives,” said Beauvais. “They all had great ideas and did a lot of research.”

Brahme said it was an opportunity for excellent feedback. “We had an opportunity to see how students looked at banks,” he said. “We don’t usually get this level of feedback unless we use a marketing firm. The students gave us a lot of information about the things that appealed to them and did comparisons with other banks. Their input has already been useful to our marketing and product teams.”

The students were delighted to get some hands-on experience.

“This was the best part of the course,” said Ladan Hafezi, who immigrated to Canada from Iran with her family. “It was useful to work on a case study that was live. We learned a number of things we’ll be able to use in our careers as we did research, talked about improving customer service and practised communicating with management.”

Junrui (Sherwin) Gao, a student from China, said the EE assignment helped him improve his writing, speaking, and presenting skills. “Many international students are shy,” Gao said. “Although we have great ideas, we may not feel comfortable using our second language to speak up. Our skills will really improve if we’re forced to speak and present via a live case study.”

Raunak Kher, who was born in India and has lived all over the Middle East, said it was “a golden opportunity to share our perspective.”

He and his group did a lot of research on immigration, but they were also able to speak from personal experience. “We wanted to show RBC how to welcome international students,” Kher said, “and suggested they should consider a financial settlement advisor who can educate students about housing options using GIC (guaranteed investment certificate) funding and about the community, as well as an incentive to make using their credit card worthwhile.”

The feedback from RBC was also valuable, Kher noted. “We wanted constructive feedback. They helped us understand what we need to work on, and the experience assisted us with transferable skills for future presentations.

“Theory trains our minds to learn, but students also need to know how to execute, and EE is good for that.”

Beauvais said it was undoubtedly valuable for the students to be forced out of their comfort zones to make a presentation to strangers. “It was definitely a real-world experience,” she said, “although one that they were able to do in a safe and trusting environment.

“The students had to decide what direction to take and what the outcome would look like. Giving, taking, deciding and negotiating are all foundational skills that are really important, as well as the hard skill of working with data.”

Brahme was impressed with the professional approach the students brought to the experience. He noted that one of the ideas the students put forth, a student price card, is something RBC is seriously considering. “It wasn’t on our radar, but we’re actively looking at implementing one,” Brahme said.

Kwan is delighted by the outcome and is looking forward to continuing her relationship with RBC for this fall’s iteration of the course.

“I call this going from Keele Street (York Campus) to Bay Street,’” Kwan said. “It helps students plan their journey between classroom and career. The energy of presenting to actual executives has a different feel to it than making a presentation to your professor.”

Courtesy of YFile.