Our Leadership

York University has long been a leader in sustainability. Steadfast in its commitment to sustainability and to ensuring sustainability is embedded into all aspects of the University’s operations, York’s Sustainability Strategy clearly delineates this in one of its goals, PL3: York University integrates sustainability into its overall financial plan, integrated resource plans and procurement, and is a responsible investor with respect to sustainability.

York University is committed to sustainable investing built around a strategy that integrates environmental, social, and governance (ESG) factors, into the overall financial management of its investment portfolios.

The University believes that these influences can affect risks and returns and that organizations that effectively manage ESG factors are more likely to endure and create sustainable value over the long term.

York University invests in Investment Manager products and York’s investment managers integrate ESG factors into their investment strategies. While our investment managers work to generate required returns for York’s Pension, Endowment and short-term working capital assets, ESG factors are consistently considered in the analysis and investment decision making.

The University monitors its investment managers, including ESG integration, engagement, and how they incorporate ESG factors in their evaluation process. York does not require its investment managers to be signatories of the United Nations Principles for Responsible Investment (UN PRI). However, all current investment managers are signatories.

Annual ESG Reporting and Investment Progress

York University has committed to reporting annually to the University community, as part of its overall reporting of investment performance, on how its investment managers incorporate ESG factors.

In 2018, York’s Board approved revisions to the Endowment’s Statement of Investment Policies and Procedures (SIPP) to reflect the University’s commitment to sustainable investing. During the ensuing years, York has become a founding member of the University Network for Investor Engagement (UNIE) and is a member in good standing for the Responsible Investment Association (RIA), the Canadian Coalition for Good Governance (CCGG), and the Carbon Disclosure Project (CDP).

York University investment portfolios continue to evolve with greater emphasis placed on investing sustainably as the University continues to work toward creating positive change for our communities, our planet and our future.

You can read more about sustainable investment at York in the Sustainable Investing 2023-24 Progress Report (PDF).

For an archive of previous sustainable investing reports, please visit the Secretariat's Sustainable Investing Reports webpage.

Key ESG factors considered by York's investment managers

Integrating the ESG (Environmental, Social, and Governance) factors into investment analysis to the extent that they are applicable to improving risk-adjusted investment performance. Integration of ESG factors is essential to the overall assessment of an investment and is expected to reduce long-term risks and improve risk-adjusted returns.

Environmental

Issues connected to responsible use of natural resources, global warming, energy usage, pollution.

Key Factors:

- Climate-change risks

- Carbon emissions

- Raw materials and water scarcity

- Pollution and waste

- Innovation, clean tech, renewable energy

Social

Factors such as how a company treats its workers, health and safety considerations, and community outreach.

Key Factors:

- Labor policies/relations and talent management

- Inclusion and diversity

- Product liability, including cybersecurity

- Controversial sourcing

- Social-impact reporting

Governance

A focus on topics including business ethics, board structure and independence, executive compensation policies and accounting practices.

Key Factors:

- Shareholder rights

- Pay equity/fairness

- Business ethics, transparency

- Board integration

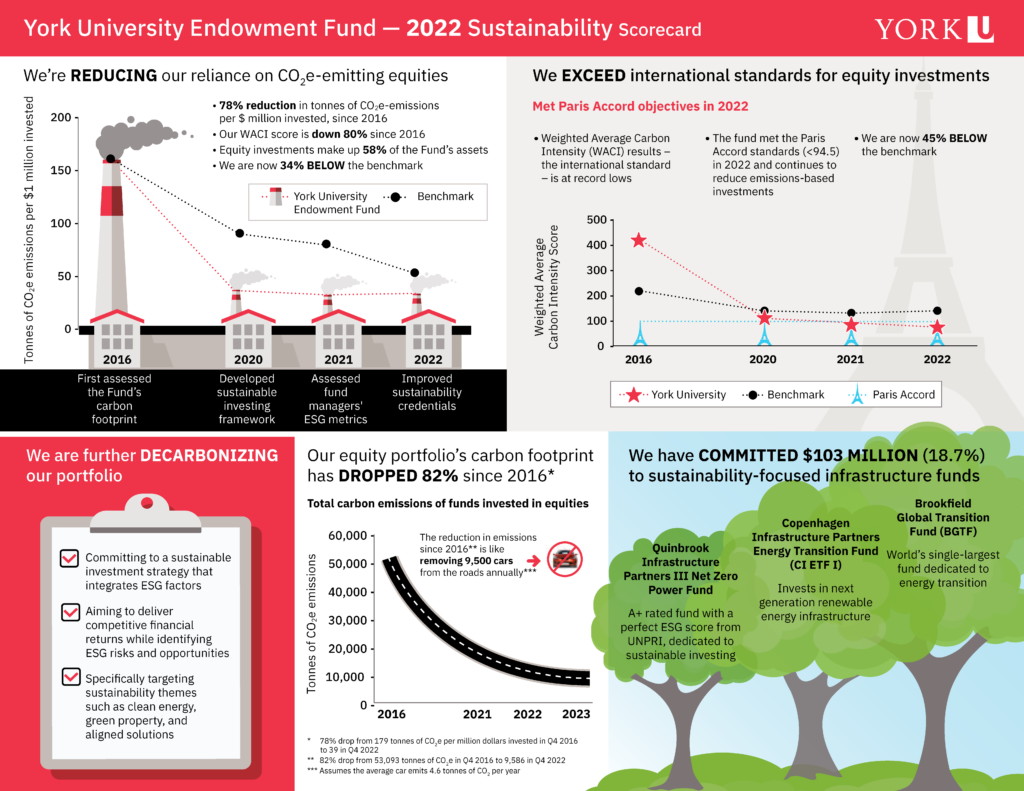

Endowment Fund Sustainability Scorecard

Links and Resources

Canadian Coalition for Good Governance

Responsible Investment Association (RIA)

University Network for Investor Engagement

York University: Carbon Neutrality 2049

York University Academic Plan 2020 - 2025

York University Endowment Fund: Statement of Investment Policies and Procedures (SIPP)

York University Pension Fund Investment Principles

York University Sustainability Strategy