The Level Up series helps new grads navigate life and work after getting their degree, with virtual and in-person events that provide opportunities for career development, learning, and professional and social networking. If you have any questions, or would like to present or host a Level Up session, please contact Senior Alumni Engagement Officer Nicole Light at nlight@yorku.ca or 647-527-2550.

Level Up will return in January 2025

Archive

Date: Oct. 22 | 5 p.m. ET

Alumni speakers: Brian Serapio (BSc ’18), Psychiatry Resident, University of Toronto and Clarelle Gonsalves (BSc ’18), Paediatrics Resident, Hospital for Sick Children/University of Toronto

Thinking about going to medical school or studying for the Medical College Admission Test (MCAT)? This event will feature intimate conversations with two successful York alumni who have recently graduated from medical school and are now excelling as doctors. Learn tips for navigating medical school admissions, the highs and lows of being a medical school student and takeaways from being an early career doctor.

Date: Tuesday, Oct. 8 | 6:30 p.m. - 8:30 p.m.

Hosts: Shantáe Bloomfield (BA ’23) Payment Service Officer & Processing Agent, Service Canada and Daniyal Mubeen (BCOM ‘22) Banking Advisor, RBC

Date: Tuesday, May 9

Hosts: Jasrin Kaur (BCOM ’23), Senior IT Project Coordinator at CIBC and Kiana Blake (BA ’18, JD ’22), Corporate Lawyer at Osler, Hoskin & Harcourt LLP

Join us for an evening of your favourite lawn games, enjoy some delicious bites from pizzeria, North of Brooklyn, and a complimentary drink while you meet other young alumni and grow your professional and social networks.

Date: Tuesday, Feb. 13, 2024 | 12 p.m. ET

Host: Ali Rushdi (MBA ’19), Omnichannel Manager, Boehringer Ingelheim Canada

Featuring recruitment specialists and hiring managers from a variety of industries, this special alumni panel will discuss ways new graduates can increase their chances of success when job hunting.

Featured panelists:

- Judith Fernando, (BHRM ’18), Campus Recruiter, IBM Consulting

- Stewart Pei (HURS ’07), Talent Sourcing Partner, Aviva Canada

- Christine Madigan (BEd ’17, BA ’17), Talent Acquisition Programs Specialist, Toromont Cat

Date: Tuesday, Nov. 7, 2023

Host: Prakash Amarasooriya, (BSc ’15), Learning Solution Architect, TD; CEO and Founder, Kashamara Productions

Are you interested in taking your career global? An upcoming panel discussion will feature successful alumni from Europe and the United States, discussing the international success they’ve had since graduation, their career paths and advice for alumni and students who are interested in doing the same.

Featured panelists:

- Representing London, UK: Marc Anthony Caporiccio (BA/BED ’11), Global Diversity Lead, Early Talent Acquisition at RBC Capital Markets

- Representing New York City, United States: Nancy Situ-Paterson (BA ’10, JD ’13), Senior Client Manager, American Express

- Representing Los Angeles, United States: Stephanie Marton (BA ’01), Senior Vice President, Edelman

Date: Tuesday, Oct. 17, 2023

Hosts: Prakash Amarasooriya, (BSc ’15), Learning Solution Architect, TD; CEO and Founder, Kashamara Productions

Have you dreamed about starting your own business or becoming an entrepreneur? Attend our upcoming virtual alumni entrepreneurship panel and Q&A and learn valuable advice for launching and growing a start-up business. This panel will feature three award-winning alumni who have launched successful start-ups as entrepreneurs.

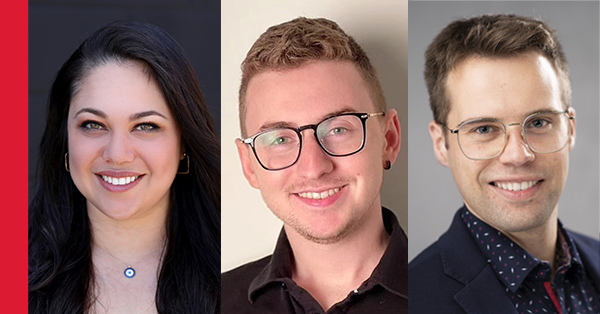

Featured panelists:

- Suzanna Alsayed (BA ’16, BA ‘17, MDEM ’20), Founder & CEO, Evolutz Inc. and 2022 York Top 30 Alumni Under 30 recipient.

- Nick Di Scipio (BEng ‘23), Founder & CEO, Pantheon Prototyping.

- Dennis Gorya, BBA ‘20, Founder & CEO, Tidal Commerce

Date: Tuesday, Sept. 26, 2023

Hosts: Ali Rushdi (MBA ’19), Omnichannel Manager, Boehringer Ingelheim and Avreen Kochhar (BHRM ’19), Human Resources Specialist Advisor, Government of Canada

Meet other young alumni and grow your professional and social networks as we kick off the Level Up series for 2023-24. This event is free to attend, but registration is required. Light food and a complimentary drink will be provided. Alumni are welcome to bring one guest.

Date: October 13, 2022

Host: Thomas Loebel, Dean & Associate Vice-President, Graduate Studies

Thinking about grad school or simply curious about your options? Listen to alumni as they share their candid experiences as grad students, why they decided to enrol in a master's program, what they wished they knew before beginning their studies, and tips on how to prepare an effective graduate school application.

Panelists include:

- Masaõ Ashtine (MSc ’13), Postdoctoral Researcher in Energy System Modelling, Department of Engineering Science at the University of Oxford

- Osman Naqvi (MMgt ’17), Advisor, Investor Services at Invest in Canada

- Sonia Sheechoria (BHRM ’15, MLCE ’19), Director Leadership Giving at Canadian Cancer Society

Date: October 26, 2022

Host: Crystal Heidari (BSc ’17, JD ’20), Family Law

Speaker: Sara Elhawash (BA Hons. ’15)

Fatigued or overwhelmed staying on top of all your social media accounts? What about marketing a product or a service for your employer or business? Listen to this session to hear from marketing expert and York alumna Sara Eldhawash (BA Hons.'15). She'll share tips and tricks relevant to the most popular social media platform and teach how to build a strategy for your personal brand or business. Sara will cover a range of topics, including content curation, building a following, account security, creating a strategy, and so much more.

Date: February 21, 2023

Host: Ajay Nandalall (BPA ’14, MPPAL ’16), AI/Machine Learning Governance & Strategy, TD Bank

Buying a home in today’s real estate market

Date: February 28, 2023

Host: Avreen Kochhar (BHRM ’19), Human Resources Specialist Advisor, Government of Canada

Speakers: Daniel Steinfeld (BBA ’04), co-founder and CEO, On The Block Realty; On The Block Auctions & Katie Steinfeld (BBA ’04), co-founder and Broker of Record, On The Block Realty

Thinking about buying your first home but unsure how to prepare for this type of life changing purchase? Join this informative session to hear from industry experts, Daniel Steinfeld (BBA ’04) and Katie Steinfeld (BBA ’04) and learn about a range of topics to help you prepare to enter the housing market.

The session will cover topics including:

- The value of getting into the market

- Deciding to rent or buy

- Down payments, financing and available rebates

- How young people like you have moved up the property ladder

- Preparing for this purchase

- Who you need to help with this process (agents, lawyers, bank, etc.)

How to file taxes in Canada (for beginners)

Date: Mar. 28, 2023

Host: Ishita Mittal, Schulich BBA Candidate 2025

Speaker: Wei En (Ryan) Chen, BComm ’22, Senior Tax Associate, MySolutions team at PwC

Thinking about filing your taxes and are unsure where to start? Join this informative session to hear from industry expert and York U alumnus, Wei En (Ryan) Chen (BComm ’22) and learn about a range of topics that will give you the confidence you need to prepare your own tax return.

This session will cover:

- Basics of the Canadian tax system — What is a tax return? Why do we need to file one? What are Canadian tax rates?

- Various types of income sources that are taxed and their implications — salary vs. investment income

- Types of tax returns available to file

- Tax slips (T3, T4, T5, T2202A, T4RSP) that are commonly applicable to new grads

- Deadlines to file your taxes

- Common tax credits and deductions available and those that are relevant to students or recent graduates

- Tax planning strategies to save or defer taxes to the future

- Tax filing software available to file tax returns

If you have any questions, or would like to present or host a Level Up session, please contact Senior Alumni Engagement Officer Nicole Light at nlight@yorku.ca or 437-235-8754.

A special thank you to our preferred partners:

Having a York University degree is a very positive thing in the eyes of these financial services providers. Tens of thousands of alumni like you have already unlocked preferred insurance rates – simply because they graduated from York.